Converting pensions into pension points. The number of pension points to receive a pension. New pension reform in Russia

The savings of the “silent people” should be transferred to a non-state pension fund, or converted into pension points

Moscow. March 16. website - The funded part within the compulsory pension system (OPS) should completely come under the “umbrella” of the new system - individual pension capital (IPC), Deputy Minister of Finance Alexey Moiseev said at the Russian Pension Congress. The concept of the new IPC pension system was developed by the Ministry of Finance and the Central Bank, and they are now preparing a corresponding bill.

“We are publicly discussing the concept, which is called IPC. When we conceived it, we perceived it as a modernization of the security system. The ultimate task is to modernize the security system and apply it to new budgetary conditions (...) You know that budgetary restrictions have developed in such a way that the budget does not provide for the possibility until 2019, and I think further, to invest funds that were going to go to the community pension fund in non-state pension funds, so the community pension system requires modernization,” Moiseev said.

“Ultimately, the goal should be (that) the OPS completely comes under the umbrella of the IPK,” the deputy head of the Ministry of Finance emphasized. Moiseev said that the savings of the “silent people” should be transferred to a non-state pension fund, or converted into pension points, that is, the Pension Fund of the Russian Federation will cease to be an insurer of funded pensions. First Deputy Chairman of the Central Bank Sergei Shvetsov agrees with him.

“We can remember as much as we want about the wonderful system that existed. Today there are no transfers from the budget to the accounts of citizens. The system has been frozen for three years already, a decision has been made on a three-year forward freeze. We can discuss why it is bad, but it does not exist "We cannot save it for the reasons that Alexey Vladimirovich has already mentioned. It will be dismantled, because the costs of administering and maintaining two systems are too high, and we cannot afford them," Shvetsov said.

Moiseev recalled that the new pension system will be based on voluntary contributions from citizens, which they will make by default, that is, a citizen who has not expressed any desire will be included in the system, and one who has declared that he does not want to participate will be excluded from the system. The developers of the concept have adjusted the benefits that are proposed to be introduced to encourage citizens to form pension capital. Initially, it was proposed to introduce a personal income tax benefit, as well as provide relief for employers on contributions to extra-budgetary funds.

The last benefit was opposed by the government's social bloc, the Pension Fund of Russia. The Ministry of Finance and the Central Bank took these objections into account. Now it is proposed to give a personal income tax deduction for citizens for the amount of deductions to the individual industrial complex, but within 6% of the salary. “The second benefit is the attribution of this 6% that a citizen pays in the IPC to the cost price with an increasing coefficient. This is approximately how IT costs are now realized. We offer the same thing here, the coefficient is currently offering 1.06, there is a point of view that this not enough, but we’ll see,” Moiseev said.

He also noted that in order to implement the automatic subscription of citizens to participate in the new system, it is necessary to create a central administrator who will administer contributions, maintain a database, inform citizens, control the receipt of contributions, as well as transfers to non-state pension funds.

Since 2015, pensions have been calculated using a new formula. But something else is much more important: to qualify for it you need to earn at least 30 pension points. This condition, first of all, affects the rights of young people: those who have little work experience. Let's look at some calculation examples individual coefficient, which will help you understand the mechanism of action of the new law and consciously plan your future.

New calculation principle

To understand the essence of the changes, here is a brief historical information. The table below shows that previously only two conditions were required to assign a pension:

- reaching the legal age;

- availability of the required labor (insurance) experience.

Its size was calculated based on two values: length of service and salary. At the same time, for the period from 2001 to 2014, it directly depended on the amount of insurance premiums transferred to the Pension Fund. They amounted to 14-16% of earnings. The formula for calculating pensions since 2015 contains a new indicator: IPC– individual pension coefficient

It represents the sum of points for each year of work, and in fact reflects a new condition: in order to receive a legal payment, you need not only to develop the required length of service, but also with such a salary that the amount of contributions paid is not less than the amount established by law.

Conditions of appointment and size calculation according to different laws

Most people who expect to retire in the near future began working during the Soviet era. For the period of validity of each of the three laws, its size is calculated differently. The amount of the insurance part of the pension will be determined from the length of service earned before 2001, salary and insurance contributions. It will then be converted into points. Let's give an example.

Example 1. Vladimir Ivanovich worked all his life as an engineer with an average income. As of December 31, 2014, I received the average Russian pension: 10030 rubles. It consists of a fixed payment (the same for everyone) - 3935 rubles. and insurance part - 6095 rubles. How many points does he have?

IPC = 6095 / 64.10 = 95

From the example it is clear that to receive an average pension you need to have about 100 units. If Vladimir Ivanovich’s IPC was equal to 30, then he would receive only 5858 rubles.

For those who are still working, the pension calculation formula works as follows:

- Individual coefficient: IPC = IPC before 2015 + IPC after 2015 until 2015. - we have already calculated using an example; after 2015 - is calculated as the sum of indicators for each year of work

- Amount of insurance pension: SP = IPK × SPK, where: SPK – point value on the day of calculation

- Overall size: FV + SP, where: FV - fixed payment (established by law)

How are pension points calculated?

Federal law annually establishes two values:

- salary limit for deduction of insurance premiums;

- the cost of a pension point (indexed at the inflation level).

The maximum (maximum) salary for 2015 is 711,000 rubles, that is, 59,250 rubles. per month; with more - no contributions are taken. The amount of insurance premiums, calculated at a rate of 16%, will be: 113,760 rubles. Let's calculate how many needed units you can earn.

Example 2. Vladimir Ivanovich continues to work and receives a monthly salary: 25,000 rubles. Insurance premiums are deducted from the amount of earnings - 16%, or 48,000 rubles. in a year. Then:

IPC 2015 = (48,000 /113,760) × 10 = 4.22

As a working pensioner, he has the right to recalculate from the amount of contributions transferred for work, but no more than 1.8 units will be taken into account.

Number of points earned depending on salary

Thus, the higher the salary, the more points. The maximum number is 10, corresponding to the maximum salary from which contributions are transferred. But the law establishes a transition period, during which the requirements will gradually increase. The table above shows that fully earned rights will be taken into account only after six years.

Calculation examples

Before giving a few examples, we note that pension units are accrued not only for work. The law establishes several periods for which contributions are not paid, but are reimbursed by the state in the following amounts.

We saw what the formula for calculating pensions in 2015 for employees looks like using the example of an ordinary Russian engineer. But there are other categories of citizens, they are also interested in knowing what awaits them.

Example 3. Young successful top manager Sergei.

He has been working since 2010, his salary is 100,000 rubles. He has 5 years of experience, his insurance premiums are for 2010-2014. recalculated in points (10). He will earn another 20 for the period 2015-2017: 7.39 + 7.83 + 8.26 = 23.48. But we already know that the amount of payment will be minimal. In addition, the law requires 15 years, so we continue to work: from 2018 to 2025: 8.70 + 9.13 + 9.57 + 5 × 10 = 77.4. Total for 15 years - 107.44. In prices of the current period, this is approximately the same average pension as Vladimir Ivanovich (95 points).

“On labor pensions in Russian Federation» , term conversion means translation of formed until 2002 pension rights of citizens in the calculated pension capital. However, after the new reform of 2015, the previously formed rights had to be transferred again into individual pension coefficients (IPC), or so-called points.The introduction of conversion was necessary for further recalculation or increase according to the new formula. Pension rights acquired before the introduction of conversion, while are saved in full, and the transfer of pension rights itself is of an undeclared nature.

New pension reform in Russia

The new pension reform in Russia has begun to take effect since the beginning of 2015, after the entry into force of Federal Laws of December 28, 2013 No. 424-FZ “About funded pension”, and dated December 28, 2013 No. 400-FZ "ABOUT insurance pensions», which guarantee the citizen provision of pension savings. Such a reform involves modification of the calculation.

Payments are calculated based on pension coefficients, and not from the generated settlement capital, as was before, and then the points are converted into cash equivalent.

The system by which pension coefficients are calculated is influenced by several factors:

- salary amount;

- funds allocated for the funded part of the pension.

- - formed from the employer’s insurance contributions to the Pension Fund for the periods of work of the insured person.

- - payment that can be formed from insurance premiums when making a decision on the formation pension savings in a non-state pension fund (NPF) or management company (MC).

If a citizen who has achieved , wants to continue working, in this case he will be paid both wages and a pension at the same time. Moreover, pension coefficients will also be calculated, which will increase the amount of payment at , and this will serve as an additional incentive to continue working.

Formula for calculating insurance (labor) pensions

Before the reform, the pension was calculated based on their accumulated pension capital - the amount of contributions for the insured person to the Pension Fund of the Russian Federation (PFR), i.e. in the period from 2002 to the end of 2014, the calculation was influenced by . Also, previously, only two conditions were required for the calculation: the required age and the presence of work experience (at least 5 years).

Since 2015, all insurance premiums began to be converted into coefficients (points) and thus a new condition appeared - the required minimum number of them.

Thus, to calculate the pension it is used new formula, established in Article 15 of Law dated December 28, 2013 No. 400-FZ “About insurance pensions”:

SP = IPC × SPK + FV,

- JV- the amount of the insurance pension;

- IPC- the amount of points earned;

- SPK- cost of 1 point on the day of appointment;

- FV- fixed payment (analogous to the basic one).

Individual pension coefficient when calculating pensions

Conversion of pension rights into points (IPC)

In connection with the 2015 reform (new calculation system), citizens working before this period acquired a certain pension capital (amount of contributions), which will transferred to IPK. Its value will be determined by the formula (clause 9 of article 15 of the law “About insurance pensions”):

IPK c = P / SPK k + ∑NP i ,

- IPK with - pension coefficient for periods before 2015;

- P- size of the insurance part labor pension(Article 14 of the Law of December 17, 2001 N 173-FZ);

- SPK to- the cost of 1 pension point, established as of January 1, 2015, is 64 rubles 10 kopecks;

- ∑NPi- total points for non-insurance periods, which existed before 2015.

The conversion began in 2014 without application based on the data available in the Pension Fund database, so the citizen does not need to submit an application. If the pension may be reduced during conversion, the calculation will be made according to the old system.

When converting, only the insurance part is taken without the basic (fixed) part, and the funded part is not included in the calculations at all; it is considered as a separate assigned one.

Maintaining the pension amount after recalculation

The legislation provides for the preservation of pensions in the same higher size in the case if the new recalculation led to its reduction, however, this is more of a guarantee and is practically not applied. In any case, the pensioner is given the right to choose a more profitable option for recalculating the payment, as well as the opportunity to keep its previous amount. Thus, excluded possibility of reducing the payment amount upon conversion.

Less than the saved pension amount can only be the calculated amount, which is determined for all citizens according to uniform rules.

This situation can arise only if the pensioner provides new information(about increased earnings or periods included in the length of service), considering that this will improve the assessment of his pension rights acquired by the beginning of 2002 and increase the size of the pension. But also in in this case, revaluation of rights is simple will not happen, and the pension is the same will not decrease.

Conclusion

Many citizens were afraid of pension recalculation after. But the conversion does not have a negative character, as it may seem at first glance, since the final amount pension provision guaranteed not to decrease in size. The point of the new system is to increase the importance insurance period And "white salary". In any case, the law provides maintaining the same amount of payments for current pensioners.

For each year, the coefficient is calculated using the formula: IPC = (SV / NSV) x 10 You can decipher it:

- IPC is the pension coefficient that needs to be calculated;

- SV - insurance premiums;

- NSV - the amount of funds equal to 16% of the PVB, they are established annually by the state.

How is the conversion into points based on the 2015 reform, working citizens already have some capital. He will be transferred to the IPC. It can be determined by the formula: IPC = P / SPK + ∑NP. In the presented formula, each component has the following meaning:

- IPC is a pension coefficient made up of amounts received before 2015;

- P - insurance labor pension;

- SPK - the size of 1 point, which the state established on January 1, 2015.

Conversion of pension rights acquired before January 1, 2015

These coefficients are different for the fixed part of the pension and the insurance part of the pension, so calculating the total amount yourself is time-consuming and inconvenient. The calculator will give the result immediately. I found out that if I stay at work for three years, my pension will increase by 25%, and if I stay at work for five years, by more than a third.

In addition, the personal account lists all the enterprises where the citizen worked. This means that even before the pension is calculated, you can check whether all the information has been received by the Pension Fund (after all, it operates only on the data sent to it by employers), whether there are any errors in the length of service and the amount of transferred contributions.

It is better to answer all questions that arise in advance. What are premium rates? With later registration of pensions from one to 10 years, the fixed payment and the insurance part of the pension increase by premium coefficients.

Conversion of pension rights into points. how it's done?

How is the total determined? seniority? The main document confirming the periods of work of a citizen before 2002 is the work book. After 2002, when the Pension Fund introduced personalized accounting, all data transmitted by enterprises about their employees is recorded in the Pension Fund database on the individual personal account of the insured.

Info

How is pension capital (pension rights) earned before January 1, 2015 taken into account? It will also be converted into points. First, the estimated pension capital as of January 1, 2002 will be determined.

Then the pension amount was calculated based on the average salary for the last two years before the pension was assigned or any five years in a row at the employee’s choice, taking into account the total length of service. In 2002, the pension law changed. Therefore, from 2002 to the end of 2014, all “white” salaries began to be taken into account, or more precisely, the number of pension contributions paid.

What is a pension point? How are pension points calculated for pensioners?

Increasing coefficient for persons who are assigned (restored or reappointed) insurance pension for old age or the specified pension could have been assigned (restored or re-assigned) when determining the size of the insurance pension in the event of the loss of a breadwinner Increasing coefficient for persons who are assigned (restored or re-assigned) an old-age insurance pension ahead of schedule or the specified pension could have been assigned when determining the size survivor's insurance pension less than 12 1 1 12 1.07 1.046 24 1.15 1.1 36 1.24 1.16 48 1.34 1.22 60 1.45 1.29 72 1.59 1.37 84 1.74 1.45 96 1.9 1.52 108 2.09 1.6 120 2.32 1.68 Amount of pension point value The legislation provides for annual indexation of the cost of one unit of pension point and the size of the fixed payment.

Conversion of pension rights acquired before 2015

Where to go for a pension? The insurance pension is paid by the Pension Fund. Cumulative - Pension Fund or Non-State Pension Fund, it depends on where you formed it. If Ivan Vladimirovich has a funded pension, then we add it to the insurance pension.

Attention

Otherwise, our hero’s retirement income will be 13,322.79 rubles per month. Size future pension can be increased It is worth remembering that the pension situation can be improved.

For example, if Ivan Vladimirovich signed up for an individual pension plan and made contributions on his own, then a non-state pension would be added to the insurance and funded pension, and his retirement income could be no less than his salary. This is important to know. There are conditions under which a pension is granted.

You must have a minimum established work experience and a minimum number of accumulated points.

Understanding the pension formula

The value of the individual pension coefficient for periods of work after January 1, 2015 is determined by the formula: IPKn = (∑IPKi + ∑NPi) / K / KN, where IPKn is the number of pension points (individual pension coefficient) for periods of work after 2015, according to as of the day from which an old-age insurance pension, a disability insurance pension or a survivor's insurance pension is assigned; ∑IPKi - the sum of individual pension points determined for each calendar year, taking into account the annual deductions of insurance contributions to the Pension Fund of the Russian Federation for the old-age insurance pension starting from January 1, 2015 in an amount equivalent to the individual part of the tariff of insurance contributions to finance the old-age insurance pension for the insured person.

About pension

Important

In your personal account, you can find out the number of points you already have (link “about generated pension rights”), calculate the number of points for 2015 based on your expected salary, and finally, by clicking on the link “pension calculator”, calculate your approximate pension. For people of pre-retirement age whose work history is generally behind them, this is not relevant, but young workers can use a calculator to approximately estimate what the insurance pension will be if, for example, they are planning to serve in the army or plan to have a child, etc.

The relevant data is entered into the calculator, and it displays the result. For older workers, another opportunity is more important: to see how the size of the pension will change if you postpone the time of its registration.

In this case, the formula provides for the use of increasing (premium) coefficients.

Pension points - calculation procedure and amount in 2018

Government of the Russian Federation;

- from April 1, it is established by the federal law on the budget of the Pension Fund of the Russian Federation for the next year and planning period based on the difference between the annual growth index of average monthly wages in the Russian Federation and the coefficient of the adjustment made to the consumer price growth index. In this case, the specified coefficient cannot exceed the growth index of budget revenues of the Pension Fund of the Russian Federation per pensioner, allocated for the payment of insurance pensions.

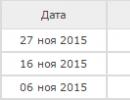

Cost of one pension point Date Amount (in rubles) From January 1, 2018 81.49 From April 1, 2017 78.58 From February 1, 2017 78.28 From February 1, 2016 74.27 From April 1, 2015 71.41 From February 1, 2015 71.41 January 1, 2015 64.10 Thus, the cost of one pension point for 2018 is 81.49 rubles.

Conversion into experience points before 2002.

The amount of the insurance pension is calculated by the formula: SPst = IPK x SPK, where: SPst - old-age insurance pension; IPC - individual pension coefficient (number of pension points); SPK is the cost of one pension point as of the day from which the old-age insurance pension is assigned. A similar formula is used to calculate the size of the disability insurance pension and the size of the survivor's insurance pension for each disabled family member of the deceased breadwinner.

Calculation of the number of pension points The procedure for calculating the value of pension points is fixed in Federal law“On insurance pension” (clause 9, article 15).

At the same time, the standard duration of the insurance period until the disabled person (deceased breadwinner) reaches the age of 19 years is 12 months and increases by 4 months for each full year of age starting from 19 years, but not more than up to 180 months; КН - coefficient for calculating the amount of old-age insurance pension and disability insurance pension equal to 1, and for calculating the amount of survivor's insurance pension - the number of disabled family members of the deceased breadwinner as of the day from which the survivor's insurance pension is assigned the relevant disabled family member; That is, the number of pension points until 2015 is calculated by dividing the amount of the estimated pension by the cost of one pension point, taking into account the established coefficients. Features of determining the number of pension points for work after 2015

- What is pension reform in the Russian Federation?

- Who can become a participant

- How savings are paid out

- Formula for calculating insurance pension

- How is the conversion to points done?

- Advantages and disadvantages of reform

- Results of the program

- Changes in 2018

Based on Law No. 173-FZ, the transfer of pension funds that were formed before 2002 has changed. In 2015, after reform, pension coefficients become points. It is important that this right can be obtained by someone who, in the process of obtaining work experience, received them in the amount of 30 units. Many believe that this position hurts young people who have not yet had time to earn work experience. To understand the mechanism of action of the new law, it is necessary to consider the formulas by which the calculation takes place.

How insurance premiums are converted into points

The participant is exempt from contributions for a year if he has not decided on their amount. The rate then increases by 1% per year until it reaches 6%. In the near future it is planned to increase it, taking into account the financial capabilities of the region and the average salary level of citizens living there. Each pensioner is given the opportunity to take advantage of pension holidays for five years.

Citizens have the right not to make contributions during the entire period. How savings are paid out Everyone who participates in the program receives their savings in equal installments for life.

In 2018, documents are drawn up for men who have turned 60 years of age, and women who have turned 55 years old.

The recent pension reform has significantly changed the principle of assigning and forming future pension accruals.

As a general rule, several types of pensions are assigned:

- Old-age payments, which are assigned from the age of 55 for women and from the age of 60 for men.

- Disability deductions, which can be assigned both childhood, and to the adult population in case of any injuries, injuries, etc.

- Survivor benefits that are paid in the event of the death of a family member who was the sole source of income. Most often, such a pension is assigned to widows with children or other dependents who require constant care and attention.

With the introduction of new legislation, pension payments are assigned based on points assigned based on monthly contributions to the Pension Fund of the Russian Federation; the insurance part of the citizen’s future pension is formed from these funds.

Mandatory conditions for receiving an insurance pension include:

- Reaching a certain age on a general basis: 55 years for the female half of society and 60 years for the male half. On a private basis, reaching a certain age depends on working conditions and the characteristics of the assignment early retirement, for example, for length of service.

- The age for civil servants to receive pension contributions has been gradually increasing since 2017 and will continue to increase to 63 years for female employees and 65 years for male employees.

- The minimum insurance period from 2024 will be 15 years.

- Availability of a certain number of pension points. From 2025, the minimum number of points will be set at 30.

An incentive program is also applied to pensioners who do not apply for a pension after they reach the established age. Additional points will be given for working activities after old age.

The insurance pension fund is formed from citizens' salary contributions through a transfer from the employer, as well as in the event that a citizen independently contributes a certain amount of funds to the Pension Fund.

How is the pension calculated?

Since 2015, a new pension reform has been carried out in Russia, thanks to which the size of a citizen’s future pension is determined based on a variety of data about him and his contributions. The previous rules for assigning pensions still exist, but apply only to persons who were born before 1967 inclusive. Other citizens must follow the new principles for assigning pensions.

The insurance pension is calculated by determining the number of pension points that the citizen managed to accumulate during his working life.

The general calculation formula is as follows:

P=OP×PKV+IPK×TsPB×PKV2

P - size pension payments, due to a citizen;

OP - a certain amount of payments due to a citizen on general terms, established by the state, the so-called. fixed payment;

PKV - an increasing exit coefficient, which is given when applying for an old-age pension if a citizen has not applied for it for a certain amount of time;

IPC is the individual coefficient of a pensioner, which is assigned based on the characteristics of the work;

TsPB - the price of the pension point, which was established during the period of registration of the pension;

PKV2 - an increasing coefficient for pensioners who continue to work despite retirement age and receiving a pension.

The fixed amount of pension accruals is formed by the Government of the Russian Federation and in 2018 is:

|

The size of the fixed rate in rubles, depending on the category of pensioner |

||||

|

Old age pensioners |

Women and men aged 55 and 60 years |

Persons who have worked in the Far North for at least 15 years with a total work experience of at least 20 years for women and 25 years for men |

Persons who have performed labor duties in areas equated to the Far North for at least 15 years and have a total work experience of at least 20 years for women and 25 years for men |

|

|

Disability pensioners |

Group I |

Group II |

III group |

|

|

Survivor pensioners |

Complete orphans |

Upon the death of one of the parents |

||

For a general calculation using the formula, other data is also required, which can be calculated by the Pension Fund or assigned at the state level.

Minimum work experience

With the introduction of new legislation, the formation of a future pension has changed significantly, and now citizens must comply with a number of rules on which the size of pension accruals depends.

The total amount of pension contributions in the future depends on several important factors, in particular:

- The amount of wages officially received by a citizen.

- Method of pension provision.

- The period of retirement.

- Duration and amount of insurance period.

The amount of insurance coverage for retirement increases annually and currently amounts to 9 years.

The general specifics of increasing the insurance period are expressed as follows:

|

Year of retirement |

Amount of insurance period |

This definition is associated with the gradual transition of citizens to a new pension system with the final transition to it in 2024.

If a citizen does not accumulate the established insurance period by the year of retirement, then he can count on only a few options for the development of events:

- Work until the minimum established insurance period is formed, so that the amount of the insurance part of pension payments is formed from it.

- Receive social pension, which is prescribed from age 60 for women and age 65 for men.

The insurance period plays an important role in determining the size of a future pension and, in general, its assignment to a particular person.

What periods are included in the length of service?

The periods included in the insurance period are regulated by Art. 11 Federal Law No. 400-FZ dated December 28, 2013.

In accordance with the provisions of this regulatory act, the following periods are included in the insurance period:

- Periods of labor activity carried out on the territory of the Russian Federation.

- Periods of other activities for which a citizen, independently or through his representative, made contributions to the Pension Fund of the Russian Federation.

- Periods of work of Russian citizens abroad, if the employer contributed funds to the Pension Fund.

Foreign citizens or stateless persons who, on their own initiative, contributed funds to the Pension Fund account, can count on receiving an insurance pension, within the framework of Art. 4 Federal Law No. 400-FZ.

Citizens who have lost their breadwinner will be able to count on receiving an insurance pension, except in cases of committing a criminal offense against the breadwinner. Moreover, the children of the deceased will be able to receive a pension until the age of 23 if they continue to study in secondary specialized and higher education. educational institutions on a full-time course.

This legislative act also defines the periods during which a citizen did not work, but received insurance experience.

Such non-insurance periods include:

- completing compulsory military service;

- caring for a disabled person Group I, a disabled child and a dependent who is over 80 years of age, inclusive;

- the period during which the wives and husbands of military personnel were in places where the spouse served, where it was impossible to get a job workplace;

- the period of work of one spouse abroad as an ambassador or consul, during which the second spouse could not find employment;

- period maternity leave for 1-4 children up to one and a half years old, but maternity leave in total should not exceed six years;

- period of receiving unemployment benefits;

- the time the person is in prison.

These periods of time are recognized as non-insurance and length of service is accrued for them only if the employer or other authorized person made contributions to the Pension Fund of the Russian Federation, as well as if the citizen carried out work before or after the non-insurance period.

Minimum wage

The amount of the minimum wage for receiving an insurance pension is not established, however, the amount of future accruals depends entirely on the income received by the citizen.

With timely and constant transfer of pension contributions, based on the minimum wage, a citizen can count on receiving a standard pension amount. Moreover, the higher the earnings, the greater the amount of funds transferred to the Pension Fund, which means the size of the pension increases significantly.

Today, the minimum wage varies from 9,489 rubles to 26,376 rubles, depending on the region and municipality of the future pensioner.

Coefficients affecting pensions

The size of the pension is affected by the pensioner’s individual coefficient; an established calculation formula is used to determine it.

The formula for the individual coefficient is as follows:

IPC = (Citizen Contributions)/(Maximum Possible Contributions)×10

Citizen contributions are taxes paid by the employer at a rate of 10 or 16%, depending on the choice of the employee. The maximum possible amount of contributions is the maximum possible amount of funds that a pensioner could contribute during his working life at a rate of 16%, established by the state based on the maximum possible number of points and their value.

Every year, the state indexes all citizens’ contributions to the Pension Fund and can increase significantly due to this. The IPC is formed thanks to the official salary, which largely determines the size of the future pension.

How to check if your pension is calculated correctly

You can find such a calculator on the official portal of the Pension Fund of Russia. It includes data on wages, the number of contributions to the Pension Fund, insurance experience and much more. With the introduction of such assistants, calculations began to be made much faster and better, and the likelihood of errors in this case is minimal.

Example of pension calculation

You can understand how the insurance pension calculation system works using this example.

So, citizen wages in the amount of 70 tr. can earn the following number of pension points for 2018:

IPC = (70,000 ×12 months ×16%)/(1,021,000 ×16%) ×10=8.22 points

The maximum established number of points that a citizen can receive in 2018 is 8.7, so the 8.22 received will be taken into account in full.

In addition to the detailed formula for calculating the insurance pension, an abbreviated formula is taken into account:

SP=IPK×SIPC×FR

SP - insurance pension;

IPC - individual pension coefficient;

SIPC - the price of one point per year of retirement;

FR - fixed amount of payments.

Today, one pension point is equal to 81.57 rubles.

For example, an employee at the time of retirement has 25 years of insurance experience, which assumes the following number of total pension points:

8.22×25 years=205.5

Based on this formula without taking into account any increasing factors, the calculation can be made as follows:

205.5 ×81.57+4,982.9=21,745.54

The citizen will receive such a pension, but increasing coefficients are not used in the calculation, for example, the number of pension points and their value in a given period of time, since indexation is constantly taking place. More accurate information can be obtained before immediate retirement.

Procedure for applying for a pension

Citizens who have the right to receive pension payments can apply for their appointment at any time after the actual occurrence of such right. You can contact the Pension Fund at the place of registration or stay, regardless of the location of the citizen and government institution.

When applying, an application for a pension is drawn up; the date of application for payments is the date of filing the application, with the exception of cases of filing documents one month before the date of pension rights.

The application is submitted to the authorized bodies in several ways:

- Personally by a citizen, when visiting a government agency to draw up a document.

- A representative who submits a document on behalf of the applicant.

- The employer of a working pensioner.

Review of the application takes about 10 days, after which the applicant is awarded pension payments.

What documents must be provided to apply for a pension?

Documents for assigning a pension vary depending on the type of pension issued.

According to general rules, pensioners must provide:

- statement;

- passport;

- representative documents, if necessary, if the interests of the pensioner are represented by a third party;

- insurance certificate of pension insurance.

It is necessary to provide not only originals, but also notarized copies.

To assign an old-age insurance pension, you must provide:

- papers establishing the duration of the insurance period;

- extract from personal account;

- documents establishing the absence of other pension payments;

- documents on dependents and disabled family members, as well as other papers that are relevant to the assignment of a pension.

General list necessary documents is established by Federal Law No. 400 depending on the circumstances of the purpose of payments.

Receiving an insurance pension is a new phenomenon for Russia, since the transition to a new pension system is long and difficult process, which is completely regulated and controlled by the state.